Bot Analytics, formerly known as Wysdom, was purchased by Calabrio in 2023.

Banking Virtual Agent exceeds expectations after big launch obstacles

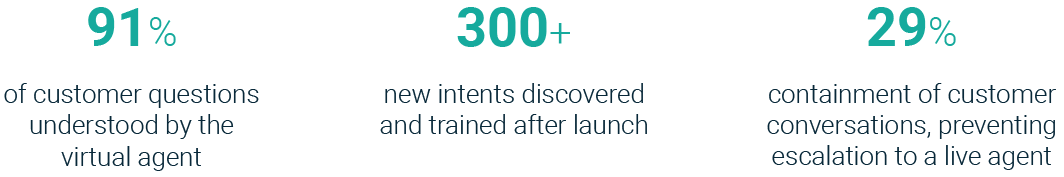

91%

Of customer questions understood by the virtual agent

300+

New intents discovered and trained after launch

29%

Containment of customer conversations, preventing escalation to a live agent

They needed a Virtual Agent that could field inquiries, be available in multiple channels, and provide exceptional digital assistance. They also wanted a virtual agent that would learn from customer interactions daily, be able to process complex tasks, and personalize experiences for authenticated customers.

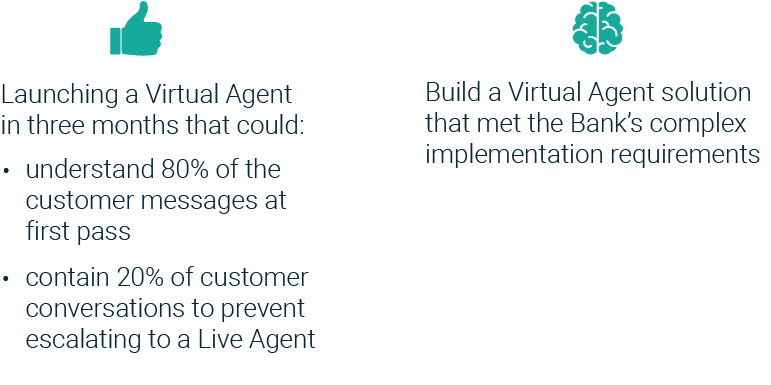

The challenge

They needed to launch the Virtual Agent within three months. It needed to understand most of the user messages and be able to contain a significant portion of the user conversation to save from escalating to a live agent. The bank required a conversational AI partner that could overcome several unique deployment challenges:

- An extensive library of self-serve help resources existed across the company’s digital assets.

- Customers required differentiated experiences based on their authentication status due to the sensitive nature of the information served.

- The bank wanted to use website usage data and LiveChat usage data to feed into the conversational AI system.

Project goals

The approach

Calabrio’s conversational AI optimization platform includes a massive, ever-growing shared library of AI data (models, customer journey templates, intents, phrases, responses, and small talk) to make virtual agents more robust and the fastest learners in the industry. This means we can get clients up and running quickly, on the platform of their choice.

“Calabrio has plenty of experience working with complex Virtual Agent deployments and has access to a banking domain-specific generic intent library,” highlights Vinay Devanira, Virtual Agent Program Director at Calabrio. “This made it easy to set everything up for the client.”

In under three months within a highly regulated industry, we were able to:

- Launch the Virtual Agent, which was trained on 800+ intents each in English and French. Given a head start due to the pre-existing reusable Calabrio Banking domain generic intent exchange.

- Leverage the Bank’s website usage and LiveChat usage historical data to harvest required content and AI training inputs, which in turn reduced the Bank team’s effort to develop content.

- Integrate the Virtual Agent with the Bank’s authentication systems to allow for an authenticated customer experience of selected topics, while also serving generic content for unauthenticated users.

The impact at launch

Results since launch

The Calabrio team continuously monitored and optimized the Virtual Agent since launch to identify content development and training opportunities based on user behaviour. Within six months of launch additional optimization gains were achieved:

Moving forward

The Calabrio team is continuously monitoring and optimizing the Virtual Agent with a goal to achieve the following KPIs by year two:

- Virtual Agent able to understand more than 95% of customer questions.

- Virtual Agent able to contain at least 35% of customer conversations from escalating to an Agent.

Looking to launch an enterprise-grade chatbot quickly?

We can get you up and running with a Virtual Agent in a matter of weeks, on the chatbot platform of your choice. You’ll see immediate improvements to customer service, employee satisfaction and the bottom line.