Customer Experience Strategies for Financial Organisations

Scalable, Robust Workforce Optimisation

and Powerful Voice of the Customer Analytics

for Your Finance Contact Centre

and Powerful Voice of the Customer Analytics

for Your Finance Contact Centre

Customer Experience Strategies for Financial Organisations

Scalable, Robust Workforce Optimisation

and Powerful Voice of the Customer Analytics

for Your Finance Contact Centre

and Powerful Voice of the Customer Analytics

for Your Finance Contact Centre

Rising Customer Expectations Have Forever Changed the Financial Industry

Changing customer expectations and demands have forever changed many industries, financial services and banking among them. Consumers now expect instant responses, personalised service and an omnichannel experience that allows them to connect with their financial service provider how they want to, anytime.

Fleeting customer loyalty is a concern, with customers switching banking alliances with the simple swipe of a finger. As a result, 72% of financial institutions say customer relationships are a top focus. And nowhere is that focus on the customer more important than the contact centre. Studies show the customer experience has now moved outside of the bank branch, with 61% of all customer interactions now happening remotely.

A changing customer experience and a renewed focus on omnichannel means financial institutions are rapidly seeing the value of providing a great contact centre experience. In fact, studies show a highly satisfied customer is worth $9,500 more than a customer with low satisfaction.

The heart of providing an exceptional customer experience begins with analysing the customer interaction data streaming into your contact centres each day.

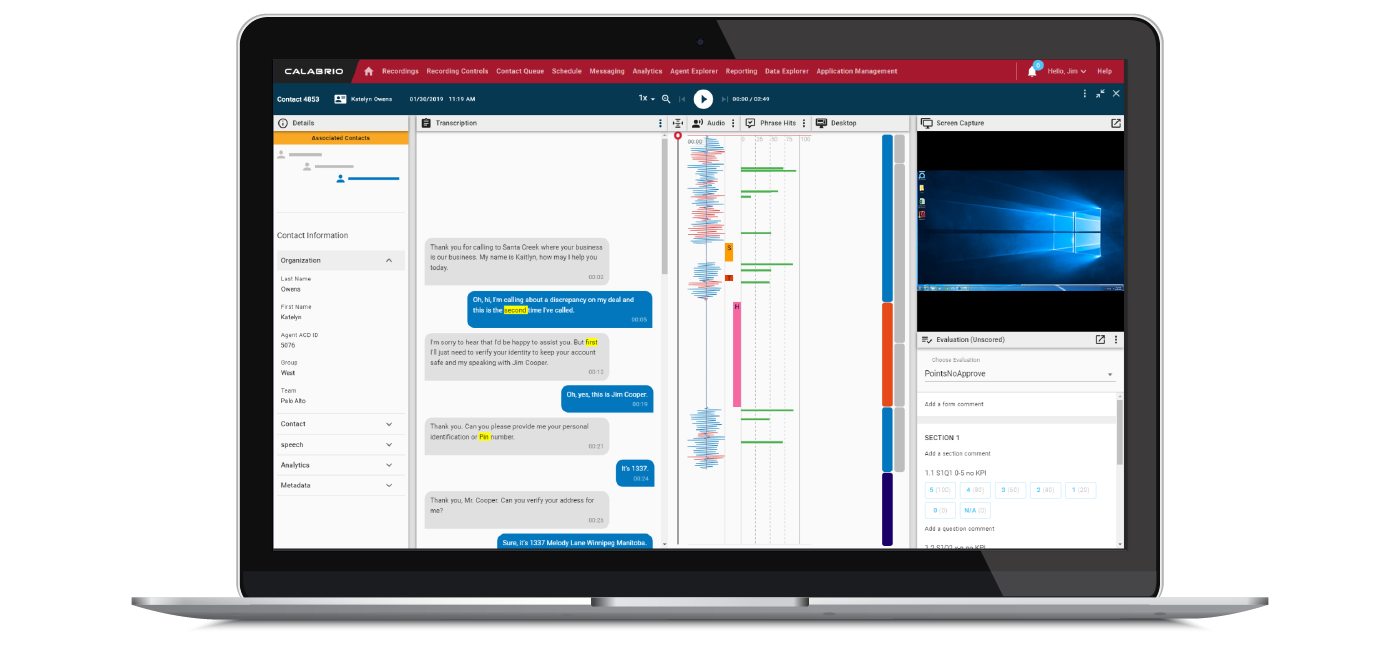

Calabrio allows you the opportunity to analyse each and every customer interaction so you can instantly discover warning signs of dissatisfied customers. Our all-in-one, intuitive software makes it easy for you to turn raw data into useful reports, allowing you to measure important contact centre KPIs such as consumer sentiment and Net Promoter Scores.

Read on to learn how Calabrio has helped financial institutions including New York Community Bank and Desert Financial Credit Union increase Customer Satisfaction (CSAT) scores up to 35%. Also be sure to check out our ebook to learn nine ways financial institutions can improve the customer experience.

What can we help you with?

Call Recording

Amazingly clean and simple. Capture and retrieve calls quickly and accurately. Never miss a call.

Quality Management

Access and evaluate 100% of your customer interactions. Gain powerful performance insights.

Workforce Management

More than optimised staffing levels, modern tools improve predictability and performance.

Calabrio Analytics

Integrate multichannel customer input to gain unprecedented visibility and control.

Data Management

Visualise call centre metrics. Cross-reference data enterprise-wide. Deliver impactful insights.

Financial Institutions: 4 Must-Have Tips to Improve Customer Experience

With brick-and-mortar locations on the decline and the majority of all customer interactions happening remotely (61%), the banking and financial customer experience has moved outside the local branch. Download our whitepaper to read more.

New York Community Bancorp Increases Customer Satisfaction Rates by 25-35% After Deploying Calabrio ONE

New York Community Bancorp (NYCB) increases both agent productivity and customer satisfaction by using Calabrio ONE.

9 Strategies to Improve the Customer Experience

61% of all banking transactions now happen remotely. Make your contact centre count. It’s no longer simply about answering phones. Download our tipsheet to read more.